Friday, June 20, 2025

Bits and Pieces

Tuesday, June 3, 2025

Updated: Town Council Set to Approve $151.5 Million Spending Cap—$4.4 Million More Than Recommended

The Oro Valley Town Council is set to approve a $151.5 million spending cap for the upcoming fiscal year at tomorrow night's public hearing—an increase of $4.4 million over the Town Manager’s Recommended Budget delivered just weeks ago. The reason for the increase is a new $4.5 million line item labeled “contingency for potential property acquisition.”

Of which Budget and Finance Commission was never told just a few weeks ago

The addition came with little public notice. At its May 20 meeting, the Town’s Budget and Finance Commission reviewed the Recommended Budget in detail. Nowhere in that discussion was a potential land purchase mentioned. The increase only appeared in revised materials published just a few days ago.

|

| Click on panel to enlarge |

In addition to the land purchase, the revised budget includes several other changes. These include $211,000 in increased funding for health insurance claims and wellness programs, $250,000 for a Naranja Park shade structure, and a $105,000 reduction due to updated capital equipment estimates for golf maintenance. A $1 million reservoir project related to the Northwest Recharge, Recovery, and Delivery System (NWRRDS) was removed from the Capital Improvement Program, offsetting part of the new spending. The panel at right summarizes all changes to the TMRB to date.

No public explanation of the purchase

No information has been provided to the public about what the Town intends to purchase, why it is needed, or how the $4.5 million figure was determined. Instead, the matter is being handled in Executive Session tomorrow night. This is a closed-door meeting allowed under Arizona law when real estate purchases are discussed. Observers say that even some Council members do not know any of the details.

Legal to include in budget...legal to keep secret

Arizona law does require municipalities to include any anticipated expenditure—such as a property acquisition—in their budget if they want legal authority to spend funds during the fiscal year. The same law permits Council to withhold the specifics from the public, at least until a purchase is finalized.

Tomorrow night's vote locks in the authority to buy property with no public input

The $151.5 million budget cap will be adopted under Resolution No. (R)25-21. Once approved, the total amount may not be increased—only reallocated among departments and projects. The final budget will be adopted after a second public hearing which is scheduled for June 18. That means that if the $4.5 million for the property purchase remains in the Tentative Budget, tomorrow night's approval gives the Town full authority to make the purchase—without ever having publicly identified what is being bought. Every other major budget change has been disclosed. This one has not.

Thursday, May 29, 2025

Bits and Pieces

BFC review of 2026 Town Manager’s Budget checks a box for town manager, but adds little value to the budget process

Oro Valley’s Budget and Finance Commission (BFC), established in 2019, has not consistently participated in the review of the Town Manager’s Recommended Budget (TMRB). While it was not involved in last year’s FY 2025 budget process, it has occasionally received presentations in prior years without playing a formal advisory role. This year was much the same as that, as staff presented the TMRB to the Commission on May 20.

The BFC did not make a substantive contribution to the development of the TMRB at the meeting. This is because the budget had already been developed and finalized for presentation by the time the BFC reviewed it. The Commission’s role was limited to reviewing and asking clarifying questions. While their discussion helped reinforce certain priorities, like fiscal sustainability and transparency, their comments led to no changes in the budget. Thus, their involvement seemed more like checking a box in the process of completing the TMRB, rather than seeking meaningful input during its development.

Town exploring new taxes to fund future capital needs

At the May 20 meeting of the Budget and Finance Commission, Town Manager Jeff Wilkins introduced a discussion about three potential new revenue sources that are not currently part of the Town Manager’s Recommended Budget. These include a use tax, a telecommunications tax, and a commercial rental tax—all of which are common in nearby municipalities like Tucson, Marana, and Sahuarita but are not currently levied in Oro Valley. Wilkins described these taxes as a way to diversify the town’s revenue base, enhance financial stability, and create a dedicated funding stream for capital needs such as roads and public safety infrastructure.

Although these proposed taxes are not included in the fiscal year 2025–26 town manager recommended budget, Wilkins used the budget presentation to make the case for exploring them. He emphasized that the town’s five-year forecast shows a capital funding shortfall by year five, and that relying solely on existing revenue sources may not be sustainable. According to Wilkins, the proposed taxes could generate between $900,000 and $1.8 million annually, and Wilkins suggested dedicating all proceeds to capital—possibly even restricting it further to public safety. Commissioners responded with questions about operational costs associated with capital projects and whether future councils would be overly constrained by strict earmarking of these new revenues.

Budget and finance commission recommends approval of $2.84 million contribution to fully fund PSPRS for FY 2026

At its May 20 meeting, the Oro Valley Budget and Finance Commission voted unanimously to recommend Council approval of the FY 2026 PSPRS pension funding policy. The policy includes a total contribution of $2.84 million to the police retirement plan—$738,817 as required by actuarial valuation and an additional $2.1 million in excess of that requirement. This extra payment is intended to eliminate the plan’s remaining unfunded liability and bring the plan to 100% funded status by June 30, 2026. Commission members supported the action after confirming the plan was financially feasible and aligned with the Council’s long-standing goal to fully fund the police pension plan.

New signs, tours, and research projects featured in OVHS May update

The Oro Valley Historical Society’s (OVHS) May newsletter highlights several new initiatives. Eight interpretive signs for Steam Pump Ranch are now in production and expected to be installed by early June, offering year-round self-guided tours. The Society also launched a redesigned website in April and is seeking volunteers to help with content and outreach. Additional efforts include digitizing historical audiovisual materials, creating an educational display about George Pusch, and continuing research on the families who shaped Oro Valley’s early history.

Disc golf returns with summer vibes and mountain views

Oro Valley’s Pusch Ridge Disc Golf Course is reopening for summer play starting this Saturday, Nestled at the base of the Santa Catalina Mountains, the 18-hole course offers daily play from 7 a.m. to 7 p.m. through September 21. New this year: weekend golf carts, short tees for novice players, and PDGA-sanctioned league play every Friday at 4:30 p.m. Tee times are required on weekends (7–11 a.m.) via PlayOV.com, while weekday play is first-come, first-served. At $10 per round, it’s a fun, affordable way to enjoy the outdoors—and the scenery can’t be beat. (Source: Town of Oro Valley Press release)

- - -

Thursday, May 15, 2025

It's Budget Time: A Quiet Review of the FY 2026 Operations Budge

The Oro Valley Town Council held a budget study session on May 5 to review the operations portion of the FY 2025–26 Town Manager's Recommended Budget. It was a quiet meeting with no pushback on department allocations and only a few clarifying questions. The budget was presented function-by-function, and councilmembers appeared content to listen and observe.

Town-wide budget holds nearly steady

Town Manager Jeff Wilkins and CFO Dave Gephart opened the session with an overview of the full $147.1 million proposed budget, which represents a 2.4% decrease from the prior year. The decline reflects a drop in capital spending, while personnel and operations costs were held nearly flat. There is only one new full-time employee proposed—a police officer. The Town continues to face rising costs for services and supplies, even as key revenues like sales taxes and state shared revenues have flattened or declined.

General Fund pressure grows

The General Fund—the Town's main operating fund—is expected to decline slightly, with a projected ending balance of $17.1 million. That leaves only a small cushion above the Town's 30% reserve requirement. Revenues from local sales taxes and state shared income taxes are either flat or falling, while one-time increases in building permits and school contracts help offset the drop. Still, the revenue increase year-over-year is only 0.5%.

Only Parks and Recreation request shows big increase

Each major department presented its portion of the budget. The Police Department will see a modest increase, primarily to cover salary step increases and benefits. The Court budget declined slightly. Parks & Recreation proposed a $1 million increase, most of it tied to operations at the Community Center and aquatics programs. Public Works will see a slight decrease, with reductions in street maintenance and capital spending offset by a notable increase in transit costs. Community and Economic Development remains stable, while the administrative departments are essentially flat.

Council questions focused on revenue

Councilmembers asked only a handful of clarifying questions—most notably about the state's flat income tax and its impact on shared revenues. There were no motions, no requests for reallocation, and no new policy direction. The tone of the meeting was professional, brief, and quiet.

Police salary negotiations will change the numbers

One factor that will impact the proposed budget is the outcome of the Town's ongoing negotiations with the police union. The FY 2026 budget includes salary increases based on the current Memorandum of Agreement (MOA), but the final agreement—which the Council will vote on separately—will include higher raises. Consequently, the Town will need to amend the budget or dip into contingency funds. Over the long term, higher base salaries will also increase the Town's required annual contributions to the Public Safety Personnel Retirement System (PSPRS).

More budget work to come

This was the second of five scheduled budget discussions. The next session will be held with the Budget and Finance Commission on May 20. Councilmembers are expected to review and adopt the final budget in June.

- - -

Wednesday, May 14, 2025

It's Budget Time: Council Questions Whether Proposed Capital Spending Is Balanced and Justified

At the April 30 budget study session, Council members questioned several aspects of the Town Manager’s recommended capital budget for fiscal 2026. The discussion focused on major areas of spending: water, public safety, streets, parks, and town facilities. Mayor Winfield presided over the session but did not ask questions. Staff answered each question and said that the current proposal reflects priorities identified in the Council's strategic plan.

Water spending and NWRRDS funding

Several questions focused on the largest area of capital spending: the Water Utility, which accounts for 62% of the $45.6 million recommended CIP. Vice Mayor Melanie Barrett asked for clarification on how much of the Northwest Recharge, Recovery, and Delivery System (NWRRDS) project is new spending versus carryover from the current year. Staff responded that approximately $8 million is carryover and $16.7 million is new funding.

Barrett also requested that future reports distinguish between groundwater preservation fees, which are paid by all water users, and water impact fees, which are paid by developers. “It would be helpful to have those separated out, since they are different sources of funding,” she said.

Community center project costs and equity

Multiple councilmembers commented on the large share of parks funding being spent at the Community Center. Vice Mayor Barrett raised concerns about over-concentrating capital spending in one part of town, saying: “It kind of feels like we just keep putting more and more and more money onto this one area… I hope that [residents in that area] will also support funding other areas of our town.”

Councilmember Mary Murphy and Councilmember Mo Green supported the proposed $950,000 to resurface the Community Center parking lot, citing safety concerns and visible deterioration. Staff explained that the pavement is crumbling and poses trip hazards. Councilmember Joyce Robb added that the older part of the lot “definitely seems like there are trip hazards,” noting that she observed them during a recent site visit.

Traffic, streets, and intersections

Vice Mayor Barrett asked whether a traffic warrant study had been completed for the $750,000 traffic signal proposed at Tangerine Road and Musette Drive. Staff responded that traffic counts had been collected and a warrant analysis was underway. She also questioned the long-term deferral of the Moore Road and La Cholla Boulevard intersection improvements, a project she said residents continue to raise concerns about.

Councilmember Robb asked about the sidewalk program and whether $100,000 annually is enough. Staff responded that the program began two years ago and that the request for next year is intended to “catch up” on backlogged repairs before scaling down to $25,000 in future years.

Parks projects and equity concerns

There was strong support among councilmembers for moving a proposed $250,000 Naranja Park shade structure from the contingent project list into the funded budget. Councilmember Nicolson said he hears frequent complaints about the lack of shade, and Councilmember Jones-Ivey asked whether drainage issues might interfere with construction. Staff said drainage is being monitored but is no longer a barrier to building shade structures.

Barrett also questioned the proposed $350,000 multi-use path near Lambert Lane, asking whether it serves the highest-priority need in the town’s trail system. Councilmember Robb suggested earmarking the funds generally for multi-use paths, to be directed to the top priority identified in the updated trails plan.

Police facility planning and project timing

Vice Mayor Barrett urged caution on the $36 million police facility project currently listed in future years of the CIP. She supported the $400,000 in the FY 2026 budget for continued planning but said, “It seems a little optimistic to me to say that in next year’s budget we’ll have something ready for $18 million.” Staff responded that the project is still in the contingent list and that scope and funding are yet to be defined.

Operations yard and long-term use

Councilmembers discussed whether to remove a $50,000 project for decommissioning the Municipal Operations Center (MOC), given that the Town also proposes spending $450,000 on fencing and other upgrades at the same location. “If you’re going to go in one direction, you wouldn’t do one of the other,” said Barrett. Councilmembers agreed to remove the decommissioning project from the long-range plan, since there are no plans to relocate Transit or Water Utility operations.

Next steps

This was the first of five public meetings on the FY 2026 budget. A follow-up session on the operating budget is scheduled for tonight. Public hearings are set for June 4 (tentative adoption) and June 18 (final adoption). Councilmembers may continue to refine budget priorities as those dates approach.

Tuesday, May 13, 2025

Council Faces Three MOU Police Pay Proposals, Each with Trade-Offs

Last week, the Oro Valley Town Council became directly involved in decisions regarding a new Memorandum of Agreement (MOA) with the Oro Valley Police Officers Association (OVPOA). The MOA defines pay, benefits, and working conditions for sworn police personnel. The current agreement, negotiated in 2021, expires on June 30, 2025.

This is the first time the Council has cut at the new MOA. As we previously reported, last week, after extensive discussion, the Council requested additional financial analysis and asked staff to present side-by-side comparisons of the union’s proposal and the Town’s most recent offers. Council members are expected to review this information and may decide on the terms of a new agreement at their next meeting.

Three proposals under discussion

Three proposals are currently under consideration. One is the union’s most recent offer, presented on April 21. Another is the Town’s “bridge plan,” also presented on April 21, which staff described as a short-term compromise to keep negotiations moving after earlier terms were withdrawn. The third is a proposal from April 14 that was later withdrawn by the Town due to concerns about its long-term financial impact, particularly its effect on pension liabilities. The union supported that offer and indicated they were close to accepting it before it was pulled.

|

| Hard to see? Click to enlarge |

All three proposals reflect agreement that police compensation must increase to remain competitive. Each includes a raise of approximately 13 percent for entry-level officers in the first year, along with annual step increases, cost-of-living adjustments, and a structured pay scale designed to attract and retain qualified personnel.

And differ in important ways

The panel at right highlights five key differences among the three proposals, ranging from the size of salary increases to long-term pension costs. In essence, the union proposal offers the most generous across-the-board increases, the withdrawn April 14 offer falls in the middle, and the bridge plan is the most modest. Each reflects a different balance between competitiveness, affordability, and long-term fiscal impact.

Why the Council is now involved

Negotiations began in September 2024 and progressed steadily until mid-April. According to the union, they were close to accepting the April 14 offer when the Town withdrew it based on updated pension analysis from its consultant, Stifel. The Town then introduced the bridge plan, which is less costly primarily because it offers smaller raises across most pay steps, especially for senior officers—reducing both wage costs and pension obligations. The union viewed the withdrawal as a breach of trust and declared an impasse on April 28. That action activated Section 3-5-6 of the Town Code, requiring that unresolved issues be submitted to the Town Council for final determination.

Budget impact in FY 2026 and 2027

Any Council decision will require a modification to the Town Manager’s Recommended Budget for FY 2026, which was developed without including major changes to police compensation. Depending on which plan is adopted, the added costs in the first year are approximately $1.48 million for the union proposal, $630,000 for the withdrawn offer, and $408,000 for the bridge plan. This is a LOVE estimate and it includes the cost of increased non pension fringe benefits. These costs can be covered by reallocating funds within the proposed budget or by increasing the overall budget limit, potentially through the use of reserves.

Council’s focus: fiscal responsibility

No member of the Council has proposed reducing police staffing or underfunding public safety. While there is discussion about the pace and structure of compensation increases, their commitment to supporting the Oro Valley Police Department remains strong. The Council’s focus is not on whether to raise police pay—all proposals include significant increases—but on how to structure those raises in a way that rewards officers, manages pension obligations, and ensures long-term town fiscal sustainability.

Wednesday, May 7, 2025

It's Budget Time: Where Oro Valley Gets Its Money

The Town of Oro Valley projects approximately $146.3 million in total revenue across all funds for FY 2025/26, according to the Town Manager’s Recommended Budget. That amount includes $21.1 million in transfers from one town fund to another. So, the net “true” revenue—excluding internal transfers—is about $125.1 million.

General fund is largest revenue source

The General Fund, which supports most town operations, is expected to receive over $57 million, primarily from local sales taxes, state-shared revenues, and fees [see panel below right]. The Water Utility Fund follows with projected revenues of about $22 million. Other key revenue sources include the Capital Project Funds ($23.2 million) and Special Revenue Funds ($15.5 million), which include seven separate funds. The largest of these is the Community Center Fund, which relies heavily on golf and recreation fees. This broad distribution of revenue supports a range of essential services, infrastructure projects, and debt obligations.

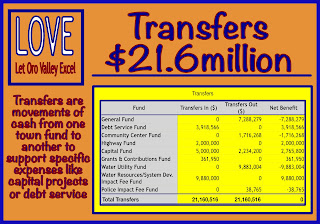

Transfers support capital and debt

The FY 2025/26 budget includes $21.2 million in interfund transfers [see panel below left], which are used to move money between funds to support specific obligations and projects. For example, the General Fund will transfer $7.3 million to other funds, including $5 million to support capital improvements and $2.2 million to cover debt service. The Community Center Fund will transfer $1.7 million to pay for bond debt tied to Parks and Recreation improvements. The Water Utility Fund is transferring $9.9 million to its capital-related fund to help finance the NWRRDS project. These transfers are fully balanced, as required by law, and ensure that each fund can meet its intended purpose without relying solely on its own revenues.

|

| Hard to see? Click to enlarge |

Despite the attention grants often receive, Oro Valley remains minimally dependent on outside grant funding. In FY 2025/26, federal and state grants combined account for less than 2% of General Fund revenues—roughly $467,000 out of more than $57 million. Most of the town’s budget is powered by reliable, recurring sources like sales tax and state-shared income. And while residents may assume that fines, permits, and interest income play a larger role, they’re actually minor contributors: fines bring in just $68,680, and permits just over $2 million. These facts remind us that Oro Valley’s financial engine runs on broad-based economic activity—not one-time handouts or punitive fees.

Town manager offers cautious outlook

In his FY 2025/26 budget message, Town Manager Jeff Wilkins takes a cautious view of Oro Valley’s revenue outlook. He notes that total revenues are projected to decline by $24 million, or 18.3%, from the prior year—largely because of the absence of $20 million in one-time water loan proceeds and a reduction in grant funding. Wilkins cites a combination of slowing residential development, flat local sales tax growth, and a decrease in state-shared income tax—due to Arizona’s new 2.5% flat tax—as contributing to this drop. He explains the town’s cautious stance, stating: “Our revenue projections reflect a slowing economy and more conservative assumptions regarding grants and development activity.” Despite this, the town maintains a stable financial foundation with diversified revenue sources and long-term planning in place.

- - -

Tuesday, May 6, 2025

It's Budget Time: Town Manager Recommends $147.2 Million Spending Limit For 2026

Council considers setting 2026 spending limit at $147.2 million

The Town Manager has recommended a spending limit of $147.2 million for fiscal year 2026. The Town Council met with staff last night to discuss this recommendation. We will report on the details of that discussion in a future article.

Capital and operational breakdown

Recommended capital improvement projects, which we’ve covered in earlier articles, total approximately $46 million. Excluding those, the remaining $96.4 million in proposed spending goes toward operating the Town’s core services. Of that amount, $20.5 million is for operating the water utility, leaving about $75.9 million for all other Town services.

The general fund’s essential role

The Town’s General Fund, which supports most day-to-day services, is budgeted at nearly $53.9 million for the year. This fund covers critical functions like police protection, road maintenance, legal services, parks and recreation, and administrative support. The Police Department accounts for the largest share—$20.5 million—while Public Works and Parks and Recreation are budgeted at $6.6 million and $5 million, respectively. Every department, from Finance to the Town Clerk’s Office, receives a share.

Where golf and community center are tracked

The Community Center Fund is budgeted at $11 million and covers the operating costs of Oro Valley’s golf courses and recreation facilities. These costs—staffing, utilities, course maintenance—are partially supported by golf memberships and user fees. Major Capital improvements are budgeted separately and paid from another fund. d Residents who use the courses, fitness areas, and pools help support this part of the budget through the fees they pay.

The rest of the budget

About $10.5 million in spending falls outside the General Fund, Community Center Fund, and water utilities. These dollars support stormwater management, street maintenance, grant programs, and debt service. Though smaller in scale, these funds are vital to maintaining infrastructure and fulfilling legal and contractual obligations. Most are supported by dedicated revenue sources such as highway user taxes, grants, and impact fees.

Contingency across the board

Every major fund in the Town’s budget includes a contingency line item to cover unforeseen expenses. These contingency amounts total approximately $7.3 million and are fully appropriated within the fund-level budgets. They are not tied to specific departments or uses and cannot be spent without Council authorization. This gives the Town flexibility to respond to emergencies or economic shifts without breaching its legal spending limit.

- - -

Friday, May 2, 2025

Bits and Pieces

On May 10, the Tucson Historic Preservation Foundation will use the patio at the Pusch House Museum to register participants for their annual spring tour of historic homes, this time in Oracle. There are iconic homes on the self-guided tour, and the Pusch House is where everyone will start. Registration is from 9 a.m. to noon, and participants will be given wristbands, maps, and shoe covers. Learn more about this tour.