The Town of Oro Valley projects approximately $146.3 million in total revenue across all funds for FY 2025/26, according to the Town Manager’s Recommended Budget. That amount includes $21.1 million in transfers from one town fund to another. So, the net “true” revenue—excluding internal transfers—is about $125.1 million.

General fund is largest revenue source

The General Fund, which supports most town operations, is expected to receive over $57 million, primarily from local sales taxes, state-shared revenues, and fees [see panel below right]. The Water Utility Fund follows with projected revenues of about $22 million. Other key revenue sources include the Capital Project Funds ($23.2 million) and Special Revenue Funds ($15.5 million), which include seven separate funds. The largest of these is the Community Center Fund, which relies heavily on golf and recreation fees. This broad distribution of revenue supports a range of essential services, infrastructure projects, and debt obligations.

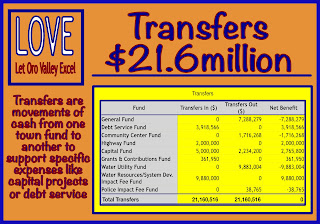

Transfers support capital and debt

The FY 2025/26 budget includes $21.2 million in interfund transfers [see panel below left], which are used to move money between funds to support specific obligations and projects. For example, the General Fund will transfer $7.3 million to other funds, including $5 million to support capital improvements and $2.2 million to cover debt service. The Community Center Fund will transfer $1.7 million to pay for bond debt tied to Parks and Recreation improvements. The Water Utility Fund is transferring $9.9 million to its capital-related fund to help finance the NWRRDS project. These transfers are fully balanced, as required by law, and ensure that each fund can meet its intended purpose without relying solely on its own revenues.

|

| Hard to see? Click to enlarge |

Despite the attention grants often receive, Oro Valley remains minimally dependent on outside grant funding. In FY 2025/26, federal and state grants combined account for less than 2% of General Fund revenues—roughly $467,000 out of more than $57 million. Most of the town’s budget is powered by reliable, recurring sources like sales tax and state-shared income. And while residents may assume that fines, permits, and interest income play a larger role, they’re actually minor contributors: fines bring in just $68,680, and permits just over $2 million. These facts remind us that Oro Valley’s financial engine runs on broad-based economic activity—not one-time handouts or punitive fees.

Town manager offers cautious outlook

In his FY 2025/26 budget message, Town Manager Jeff Wilkins takes a cautious view of Oro Valley’s revenue outlook. He notes that total revenues are projected to decline by $24 million, or 18.3%, from the prior year—largely because of the absence of $20 million in one-time water loan proceeds and a reduction in grant funding. Wilkins cites a combination of slowing residential development, flat local sales tax growth, and a decrease in state-shared income tax—due to Arizona’s new 2.5% flat tax—as contributing to this drop. He explains the town’s cautious stance, stating: “Our revenue projections reflect a slowing economy and more conservative assumptions regarding grants and development activity.” Despite this, the town maintains a stable financial foundation with diversified revenue sources and long-term planning in place.

- - -