BFC review of 2026 Town Manager’s Budget checks a box for town manager, but adds little value to the budget process

Oro Valley’s Budget and Finance Commission (BFC), established in 2019, has not consistently participated in the review of the Town Manager’s Recommended Budget (TMRB). While it was not involved in last year’s FY 2025 budget process, it has occasionally received presentations in prior years without playing a formal advisory role. This year was much the same as that, as staff presented the TMRB to the Commission on May 20.

The BFC did not make a substantive contribution to the development of the TMRB at the meeting. This is because the budget had already been developed and finalized for presentation by the time the BFC reviewed it. The Commission’s role was limited to reviewing and asking clarifying questions. While their discussion helped reinforce certain priorities, like fiscal sustainability and transparency, their comments led to no changes in the budget. Thus, their involvement seemed more like checking a box in the process of completing the TMRB, rather than seeking meaningful input during its development.

Town exploring new taxes to fund future capital needs

At the May 20 meeting of the Budget and Finance Commission, Town Manager Jeff Wilkins introduced a discussion about three potential new revenue sources that are not currently part of the Town Manager’s Recommended Budget. These include a use tax, a telecommunications tax, and a commercial rental tax—all of which are common in nearby municipalities like Tucson, Marana, and Sahuarita but are not currently levied in Oro Valley. Wilkins described these taxes as a way to diversify the town’s revenue base, enhance financial stability, and create a dedicated funding stream for capital needs such as roads and public safety infrastructure.

Although these proposed taxes are not included in the fiscal year 2025–26 town manager recommended budget, Wilkins used the budget presentation to make the case for exploring them. He emphasized that the town’s five-year forecast shows a capital funding shortfall by year five, and that relying solely on existing revenue sources may not be sustainable. According to Wilkins, the proposed taxes could generate between $900,000 and $1.8 million annually, and Wilkins suggested dedicating all proceeds to capital—possibly even restricting it further to public safety. Commissioners responded with questions about operational costs associated with capital projects and whether future councils would be overly constrained by strict earmarking of these new revenues.

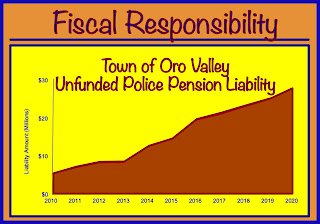

Budget and finance commission recommends approval of $2.84 million contribution to fully fund PSPRS for FY 2026

At its May 20 meeting, the Oro Valley Budget and Finance Commission voted unanimously to recommend Council approval of the FY 2026 PSPRS pension funding policy. The policy includes a total contribution of $2.84 million to the police retirement plan—$738,817 as required by actuarial valuation and an additional $2.1 million in excess of that requirement. This extra payment is intended to eliminate the plan’s remaining unfunded liability and bring the plan to 100% funded status by June 30, 2026. Commission members supported the action after confirming the plan was financially feasible and aligned with the Council’s long-standing goal to fully fund the police pension plan.

New signs, tours, and research projects featured in OVHS May update

The Oro Valley Historical Society’s (OVHS) May newsletter highlights several new initiatives. Eight interpretive signs for Steam Pump Ranch are now in production and expected to be installed by early June, offering year-round self-guided tours. The Society also launched a redesigned website in April and is seeking volunteers to help with content and outreach. Additional efforts include digitizing historical audiovisual materials, creating an educational display about George Pusch, and continuing research on the families who shaped Oro Valley’s early history.

Disc golf returns with summer vibes and mountain views

Oro Valley’s Pusch Ridge Disc Golf Course is reopening for summer play starting this Saturday, Nestled at the base of the Santa Catalina Mountains, the 18-hole course offers daily play from 7 a.m. to 7 p.m. through September 21. New this year: weekend golf carts, short tees for novice players, and PDGA-sanctioned league play every Friday at 4:30 p.m. Tee times are required on weekends (7–11 a.m.) via PlayOV.com, while weekday play is first-come, first-served. At $10 per round, it’s a fun, affordable way to enjoy the outdoors—and the scenery can’t be beat. (Source: Town of Oro Valley Press release)

- - -